As a brand-new pilot, one of the first things you learn is how to mitigate the risk of the potentially deadly physiological phenomenon known as spatial disorientation or spatial-D. In pilot speak, spatial-D is when your body is telling you one thing and your flight instruments (and airplane) are telling you something completely different. Sadly, spatial-D has claimed the lives of many pilots.

One of our newest Leading Edge team members and previous Marine F/A-18 fighter pilot, Mark Covell discusses just one example of spatial-D. Mark shares how carrier pilots tend to feel like they are pitching up as they are launched off the carrier at night due to the massive acceleration from the catapult. During daytime VFR conditions, this is probably a non-issue. However, in weather or at night, this type of spatial-D is potentially deadly.

What does spatial-D have to do with investing and retirement planning? Personally, I feel like all of 2020 could be compared to being catapulted off a carrier at night, not knowing what is up or what is down.

During the heat of the battle from February until the markets settled a bit in early April, investor emotions were all over the place. Years of stock market gains evaporated in days, even hours. Furthermore, many people thought, and the news media quickly suggested, we were headed for the second Great Depression. Don’t get me wrong, anything was (and is) possible. Sometimes, the unknown can be terrifying.

One slightly humorous example of investor spatial-D was early in the pandemic when the share price of ticker symbol ZOOM increased dramatically due to investors buying up shares as quickly as possible. Zoom Technologies, a so-called penny stock had risen more than 240% in the span of a month before the SEC suspended trading. Unfortunately, the traders failed to realize the ticker symbol ZOOM did not represent the Cloud Video Conferencing company Zoom they thought they were purchasing – Ticker symbol ZM.

In the airplane, pilots must fight spatial-D by cross-checking and TRUSTING their instruments. As an investor, if you did not trust your instruments during 2020, it may have been very costly.

So, it’s a dark and stormy night, what are the instruments you rely on and trust? What are your primary and backup instruments? Here are four instruments that I think can save your investments as well as your financial sanity during uncertain times…

1. Cash reserves

Emergency Funds. Having extra cash can prevent withdrawals from retirement accounts or excessive credit card debt in emergencies. Studies also show having cash in the bank makes people happy. In an article posted on PYMNTS.com, Can Cash Really Make You Happier, Joe Gladstone, research associate at the University of Cambridge in the U.K. and co-author of two recent studies about money and happiness said,

“We find a very interesting effect: that the amount of money you have in your bank account right now is a better predictor of happiness than your aggregate wealth,” Gladstone explained. “Having more money in their bank account makes people feel more financially secure, which leads to an increase in happiness.”

2. Have a working knowledge of financial history.

You don’t have to be an expert or financial historian, but I believe being familiar with financial history is akin to training before you go on a flying mission. New military pilots call this chair flying. Athletes and musicians use a technique called visualization that helps them prepare for uncertainty and reduce anxiety before a sporting event or concert.

3. Admit that times are scary and you do not know what’s going to happen.

This may sound obvious, but I’ve seen many people get themselves into a “square corner” because they assumed that something was going to happen when in fact there was no indication or possible way of knowing what the future may hold. We have heard investors say, “My gut tells me…” many times. Don’t ever make investment decisions based on what your gut tells you!

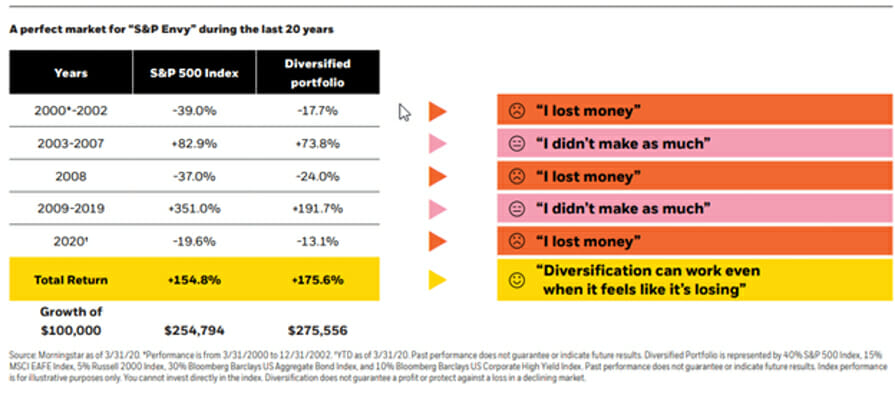

Some of the best investors in the world invest with the mindset of preparing to be wrong. In other words, they diversify their investments. Diversification is not popular or sexy because it’s like admitting that you’re not all-knowing and you do not know what’s going to happen in the future. Diversification allows you to be successful in multiple investment and economic scenarios. Furthermore, diversification can feel disappointing but prove to be a profitable strategy over the long term.

BlackRock Investment Management Company posted the graphic below on their investor education website about diversification and “S&P Envy” over the last 20 years.

4. Prepare and Plan by having a clear vision of your goals and priorities.

If you don’t understand the “why” behind your investment strategy as well as why you’re investing and saving in the first place, you will most likely bail out on your plan during difficult and uncertain times. Changing your investment plan mid-crisis creates a very high likelihood that your investment returns will be significantly lower than had you remained invested as originally planned. Simon Sinek started a movement by encouraging businesses to “Start with Why.” It’s a powerful mindset that leads to trust, inspiration and success. I believe the same applies to your financial and investment game plan.

5. Remember you are invested in companies – not politics.

Sometimes our politics cloud the investment and retirement planning picture. This rule falls under the axiom; “control the controllable.” If you’re allowing your politics to affect your investment game plan than you may want to see rules number two and three above.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this Podcast will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Moreover, you should not assume that any information or any corresponding discussions serves as the receipt of, or as a substitute for, personalized investment advice from Leading Edge Financial Planning personnel. The opinions expressed are those of Leading Edge Financial Planning and are subject to change at any time due to the changes in market or economic conditions.