In the airplane, pilots must fight spatial-D by cross-checking and TRUSTING their instruments. As an investor, if you did not trust your instruments during 2020, it may have been very costly.

So, it’s a dark and stormy night, what are the instruments you rely on and trust? What are your primary and backup instruments? Here are four instruments that I think can save your investments as well as your financial sanity during uncertain times…

1. Cash reserves

Emergency Funds. Having extra cash can prevent withdrawals from retirement accounts or excessive credit card debt in emergencies. Studies also show having cash in the bank makes people happy. In an article posted on PYMNTS.com, Can Cash Really Make You Happier, Joe Gladstone, research associate at the University of Cambridge in the U.K. and co-author of two recent studies about money and happiness said,

“We find a very interesting effect: that the amount of money you have in your bank account right now is a better predictor of happiness than your aggregate wealth,” Gladstone explained. “Having more money in their bank account makes people feel more financially secure, which leads to an increase in happiness.”

2. Have a working knowledge of financial history.

You don’t have to be an expert or financial historian, but I believe being familiar with financial history is akin to training before you go on a flying mission. New military pilots call this chair flying. Athletes and musicians use a technique called visualization that helps them prepare for uncertainty and reduce anxiety before a sporting event or concert.

3. Admit that times are scary and you do not know what’s going to happen.

This may sound obvious, but I’ve seen many people get themselves into a “square corner” because they assumed that something was going to happen when in fact there was no indication or possible way of knowing what the future may hold. We have heard investors say, “My gut tells me…” many times. Don’t ever make investment decisions based on what your gut tells you!

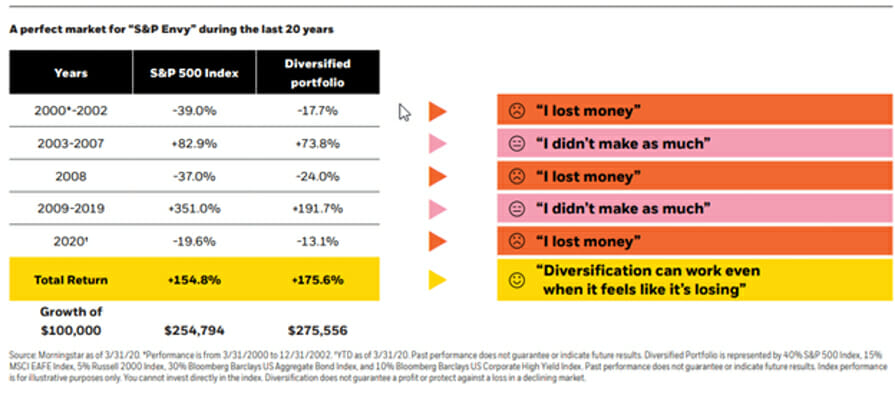

Some of the best investors in the world invest with the mindset of preparing to be wrong. In other words, they diversify their investments. Diversification is not popular or sexy because it’s like admitting that you’re not all-knowing and you do not know what’s going to happen in the future. Diversification allows you to be successful in multiple investment and economic scenarios. Furthermore, diversification can feel disappointing but prove to be a profitable strategy over the long term.

BlackRock Investment Management Company posted the graphic below on their investor education website about diversification and “S&P Envy” over the last 20 years.